In the rapidly evolving world of retail technology, few innovations have drawn as much attention as cashierless checkout systems. Among the startups attempting to carve a niche in this space, Grabango emerged with bold ambitions and significant backing. Established in 2016, the Berkeley-based company sought to revolutionize the shopping experience by utilizing advanced computer vision and machine learning to facilitate checkout-free shopping. However, recent developments have seen Grabango succumb to the difficulties of securing sufficient funding, ultimately leading to its closure. This article explores the trajectory of Grabango, its ambitions within the industry, and the factors that contributed to its downfall.

Cashierless checkout technology offers the promise of speeding up the shopping experience while reducing the need for traditional checkouts and cashiers. Grabango positioned itself as a direct competitor to heavyweights such as Amazon, which launched its own version of cashierless technology branded as Just Walk Out. This marketplace competition is characterized by fast-advancing technology, changing consumer behaviors, and an intense race for funding.

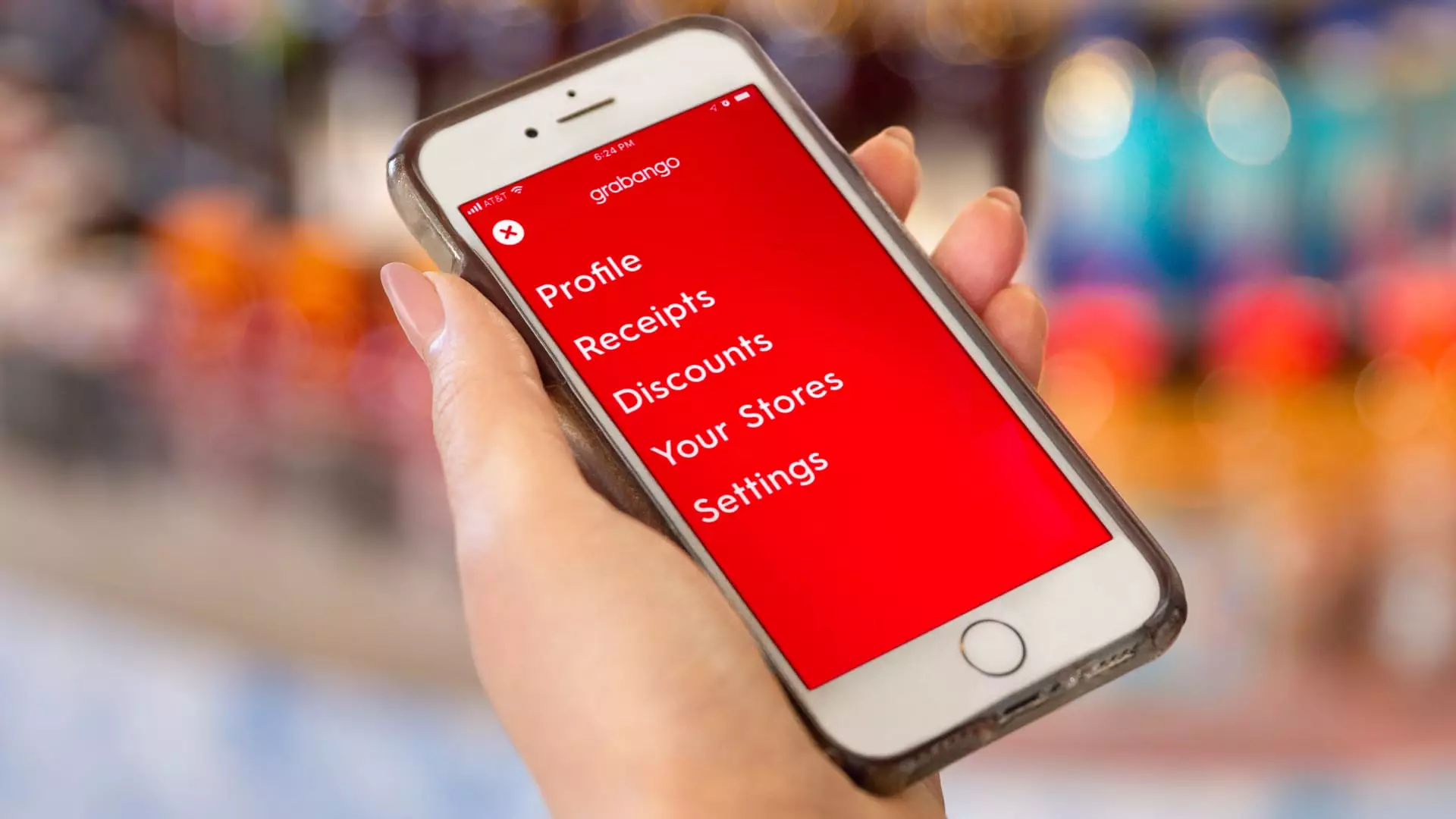

Grabango’s innovative approach included computer vision systems designed to track shoppers as they pick items, eliminating the need for any barcode scanning or cash registers. By creating an environment where customers could simply walk out with their selected goods, the startup differentiated itself from competitors that relied on sensor technology embedded in shelves. Founder’s vision, spearheaded by Will Glaser—an established technologist with a strong background in startups—provided crucial differentiation in the crowded field.

Despite an initial successful funding round that netted over $73 million, Grabango’s ambitions encountered significant financial hurdles. The company’s most substantial financing infusion occurred in mid-2021, a time when economic uncertainties were beginning to creep into the venture capital market. The market climate dramatically shifted following the onset of economic slowdowns, leading to a constriction in available capital for startups, particularly those outside of flourishing sectors like artificial intelligence.

The venture-backed startup ecosystem has largely faced challenges since early 2022, exacerbated by a stagnant IPO market in which only a few companies managed to go public. As resources dwindled, Grabango found it increasingly difficult to maintain its operations and support its growth plans—eventually leading to its unceremonious exit from the market.

In addition to struggling with financial stability, Grabango faced fierce competition. The market for cashierless technology is not solely dominated by Amazon; numerous startups, including AiFi and Trigo, continued to innovate and secure partnerships with retail giants. While Grabango forged crucial alignments with notable grocers and convenience store chains like Aldi and 7-Eleven, it was unable to scale its operations rapidly enough to compete effectively against Amazon’s pervasive reach and resources.

Amazon’s dominance and aggressive strategies placed additional pressure on startups like Grabango. The tech giant’s Just Walk Out system was deeply integrated across multiple retail formats, streamlining operations and maximizing its market presence. As the landscape shifted, Grabango’s innovative solutions began to fade beneath the weight of its competitors’ resources and experience.

The demise of Grabango offers critical insights into the nature of startup growth within a high-tech retail environment. First and foremost, it highlights the importance of securing sustainable funding, particularly in a climate where investor sentiment can shift abruptly. Despite product innovation and initial success, without a robust financial model, even the best ideas can flounder.

Secondly, the competitive dynamics in high-stakes markets reinforce the necessity for startups not only to innovate but also to strategically establish themselves among competitors. Rapid resource acquisition and agility are essential; maintaining pace with industry leaders can be the difference between survival and extinction.

The journey of Grabango serves as a poignant reminder of the volatility that characterizes the tech startup landscape, particularly within the realm of advanced retail technologies. While its ambition to redefine the checkout experience was commendable, the hurdles of financial viability and competitive pressure proved insurmountable. Future entrants into the cashierless domain would benefit from understanding these challenges, balancing technological innovation with pragmatic business strategies to navigate the complexities of the modern retail landscape.