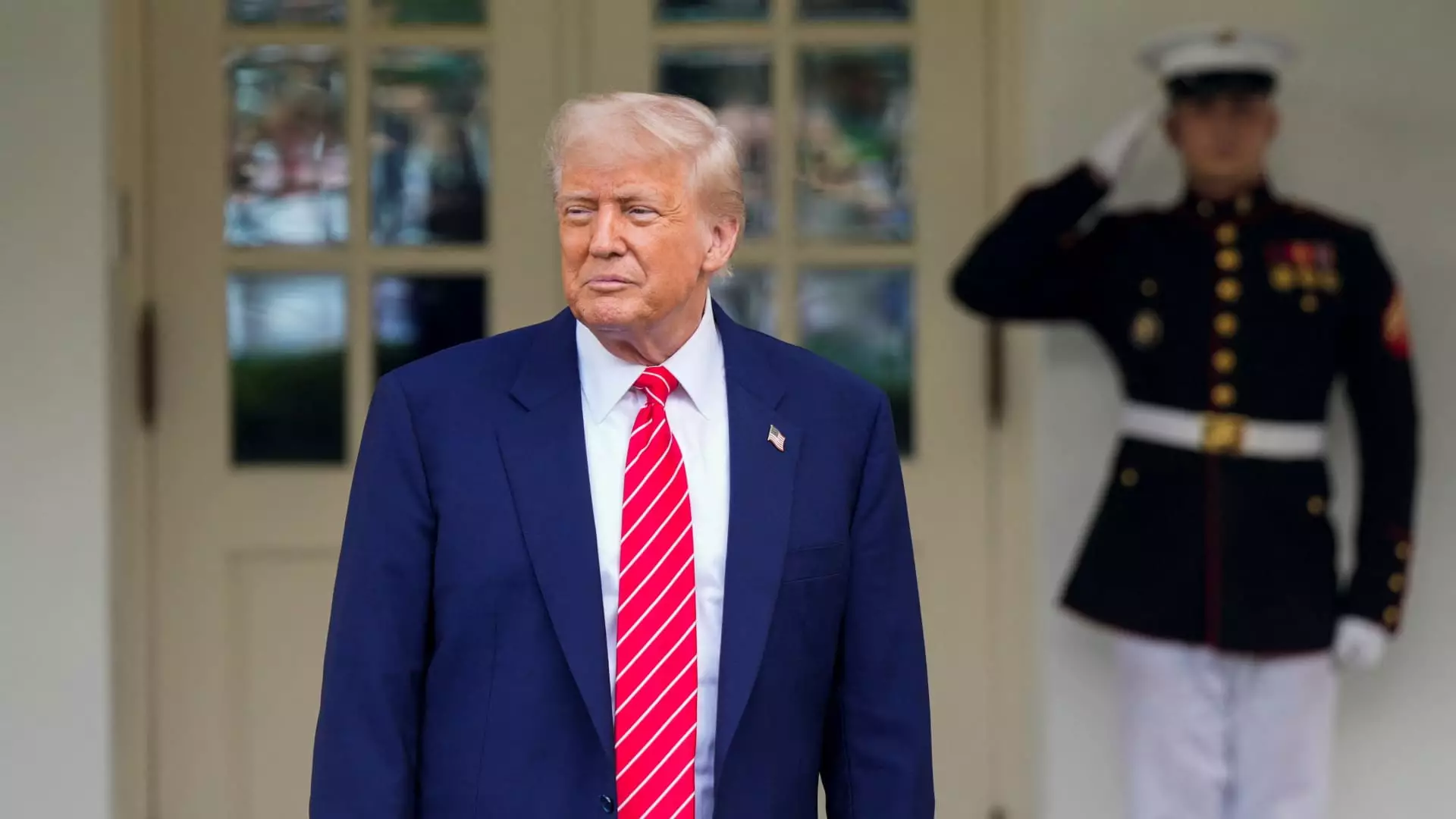

In a frustrating twist of fate for cryptocurrency advocates, the ambitious push for crypto legislation in the U.S. has seemingly hit a colossal snag, and the root of this setback points squarely at one individual: President Donald Trump. The Senate’s recent rejection of the GENIUS Act, a bipartisan effort designed to structure a regulatory framework for stablecoins, highlights how personal financial entanglements can derail much-needed policy advancements. As discussions about regulating these digital assets evolve, they are being overshadowed by concerns about the president’s own crypto ventures, which some lawmakers perceive as a significant conflict of interest.

Stablecoins: The Need for Clear Regulations

Stablecoins, which are cryptocurrencies pegged to stable assets like the U.S. dollar, have emerged as pivotal players in the crypto marketplace. Their design aims to bring stability and encourage adoption, enticing investors who might be skeptical of the volatility typically associated with cryptocurrencies. However, the absence of a clearly defined regulatory framework threatens their legitimacy and creates uncertainty for both consumers and investors. The GENIUS Act’s intention was to provide a much-needed set of regulations; however, as opt-outs from potential supporters showcase, political maneuvering is as dangerous as digital scams in the crypto arena.

The Personal Profits Problem

When personal interests overshadow public duty, the fallout is rarely pretty. Trump’s cryptocurrency endeavors, notably the launch of his meme coin, are emblematic of a concerning trend. Critics argue that these efforts create a “pay-for-play” environment, where financial stakes could unduly influence political processes. Senator Jeff Merkley voiced this concern candidly, stating, “Currently, people who wish to cultivate influence with the president can enrich him personally by buying cryptocurrency he owns or controls.” This narrative has provided fertile ground for division amongst lawmakers, ultimately stalling bipartisan consensus essential for legislative progress.

The Impediments to Bipartisanship

Despite positive momentum with some Senate Democrats supporting stablecoin regulations, the battle is excessively complicated. With only a slim Republican majority in the House and a filibuster-proof requirement in the Senate, the situation becomes even more dire. The infusion of Trump’s personal financial stakes into the legislative mix injects potential bias, prompting even prior supporters within his party to step back. Laws like the “End Crypto Corruption Act,” introduced by Democrats, signify the growing unease with Trump’s dual role as a president and entrepreneur. The call for more stringent anti-money laundering measures underscores the profound mistrust that exists—a reflection of how deeply intertwined personal and political agendas have become.

Disenfranchised Investors: The Cost of Personal Stakes

The impact of Trump’s personal stakes in cryptocurrency ventures reaches beyond legislative failures; it disheartens an industry keen on innovation and progress. Entrepreneurs and investors are left grappling with a paralyzed regulatory environment, where every legislative step forward is overshadowed by Trump’s financial aspirations. Ryan Gilbert, founder of fintech venture fund Launchpad Capital, articulately framed the issue, lamenting how personal business interference can cripple vital policy formation. “It’s unfortunate that personal business is getting in the way of good policy,” he said, offering insight into the frustrations felt by many within the crypto community.

Democratic Response: Calls for Accountability

The political landscape is marked by an increasing call for accountability among elected officials. Prominent Democratic figures, including Senators Elizabeth Warren and Kirsten Gillibrand, have not shied away from openly criticizing the conflicts tied to Trump’s ventures. Gillibrand’s assertion that stablecoin regulations are vital for both economic stability and consumer protection echoes the urgency with which many view legislative action. Yet, digestion of these grievances must be balanced with procedural realities, as highlighted by opposition from several Democratic senators who have shifted their stance on support for the GENIUS Act.

International Implications: U.S. Crypto Reputation at Stake

As ongoing debates in Congress rattle on, the international cryptocurrency community looks on with a mix of concern and incredulity. While nations around the globe make strides to adopt digital currencies, the U.S.’s legislative disarray positions it at risk of losing its standing as a leader in financial innovation. For Gilbert and like-minded advocates, the consequences of Trump-driven conflicts may result in the U.S. becoming “the laughing stocks of the world.” Such perceptions can stymie international investments and collaboration, leading to a potentially stagnating environment for U.S.-based crypto innovations.

The path forward seems littered with obstacles. For the crypto community, the stakes could not be higher, as legislative failure translates directly into lost opportunities for growth and leadership on the global stage. With Trump’s personal investments casting a long shadow over the legislative landscape, one can’t help but wonder how much longer stability in the cryptocurrency space can be realistically pursued.