On the eve of Nvidia’s fourth-quarter earnings report, all eyes are on Wall Street as analysts eagerly anticipate the company’s performance for the last quarter, which is projected to be nothing short of exceptional. Expectations are for adjusted earnings per share (EPS) to hit $0.84, with revenues estimated at an impressive $38.04 billion. As Nvidia prepares to unveil this data, it stands at the end of a year marked by extraordinary growth, driven significantly by surging demand for its graphics processing units (GPUs) essential for Artificial Intelligence (AI) applications like ChatGPT, developed by OpenAI.

A snapshot of Nvidia’s revenue statistics reveals an anticipated 72% surge for the quarter that concluded in January, with the fiscal year’s overall revenues projected to exceed $130 billion—more than double the previous year’s figures. This meteoric rise has positioned Nvidia as a dominant force in the tech industry, witnessing its stock value escalate dramatically by over 440% in the past two years. The firm’s market capitalization has eclipsed $3 trillion, further solidifying its reputation as a pillar of American corporate success.

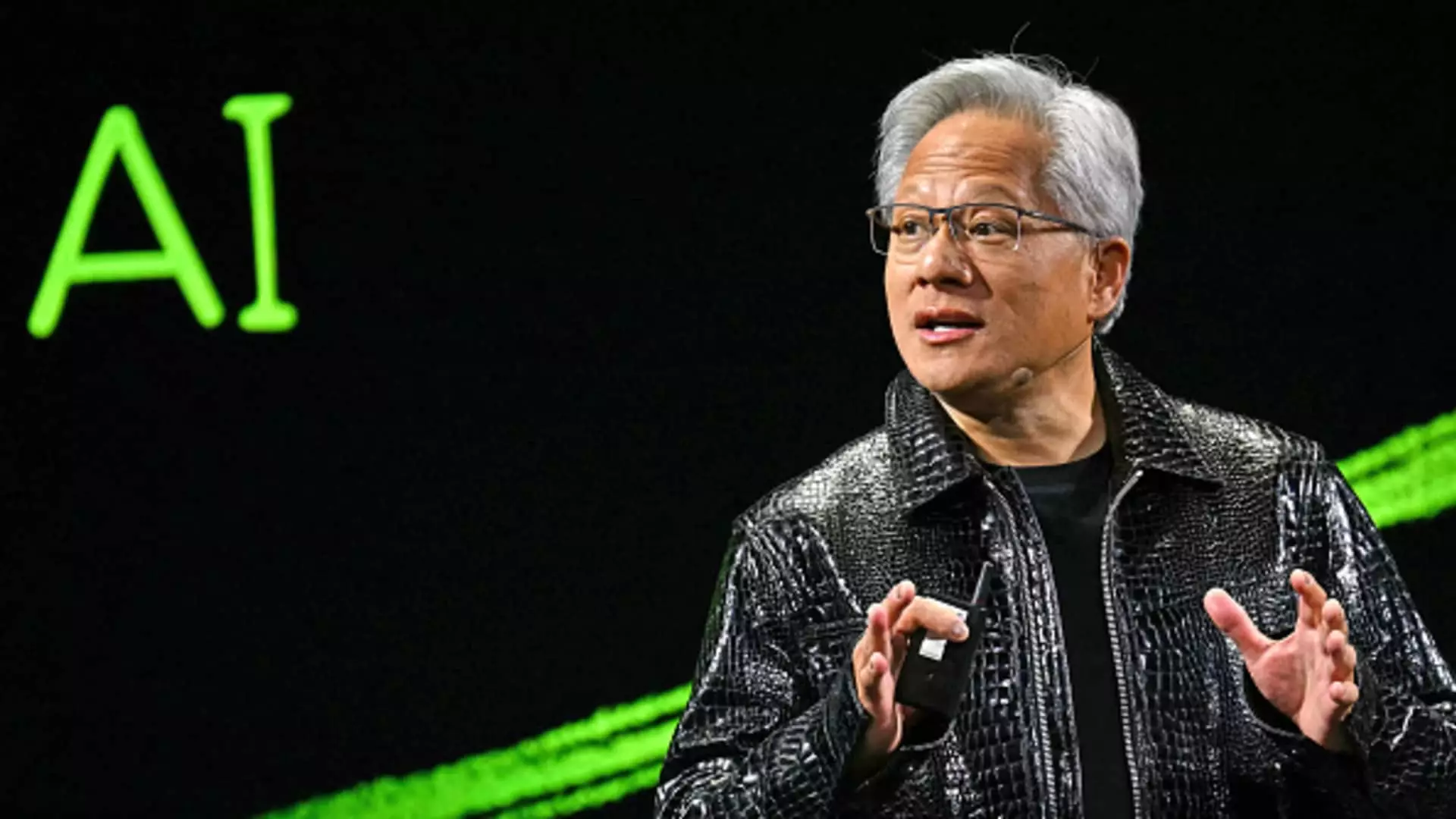

However, stock performance has hit a plateau recently, with shares hovering at levels seen last October. Investors are increasingly apprehensive about Nvidia’s future trajectory. As the AI boom matures, questions loom regarding the sustainability of such rapid growth. Analysts eagerly await insights from Nvidia’s CEO Jensen Huang, who will shed light on investor concerns about projected demand from NVIDIA’s hyperscale cloud customers — its primary revenue drivers.

Heightened scrutiny has emerged surrounding the spending patterns of major cloud clients, leading to a cautious environment for Nvidia. Reports suggest that companies like Microsoft may be scaling back their capital expenditures in the wake of adjusting to broader economic realities. This concern is further exacerbated by the rise of competitors like DeepSeek, whose new AI model poses challenges to the assumption that continuous enhancements from Nvidia’s chips are indispensable for technological advancements.

Moreover, regulatory pressures are in play as rumors surface of potential U.S. restrictions on Nvidia’s chip exports to China over national security concerns. Such limitations could hamper the company’s ability to serve one of its most lucrative markets, thus affecting its overall growth potential. Nvidia has already been restricted from supplying its most advanced AI chips to China, indicating that the regulatory landscape may significantly influence its revenue streams moving forward.

The rollout of Nvidia’s latest AI chip, Blackwell, is yet another focal point for investors. Concerns have arisen around production delays attributed to challenges related to heating and yield factors. Analysts from Morgan Stanley have estimated that leading tech firms like Microsoft and Google will contribute significantly to the expenditure on Blackwell, forecasting Microsoft alone to account for nearly 35% of Blackwell’s sales by 2025.

Despite fears of diminished growth in AI infrastructure—indicated by Microsoft’s reported decision to cancel leases with private data center operators—official statements clarify that Microsoft intends to invest heavily in its infrastructure, projecting around $80 billion in spending by 2025. Competitors like Alphabet and Meta have also divulged sizable investment plans, further asserting that demand for digital infrastructure remains robust.

As Nvidia prepares to unveil its financial results, investors will be keenly listening for guidance regarding its fiscal 2026. Crystal clear communication from leadership about maintaining strong relationships with hyperscale cloud clients, coupled with projections for revenue growth following last year’s high sales figures, will be paramount not just in quelling investor anxiety but in shaping the future narrative for the company’s trajectory. The duality of Nvidia’s ongoing triumphs and emerging challenges paints a complex picture as the technological landscape continues to evolve. How Nvidia navigates its path in this rapidly shifting environment will be crucial not only for its stakeholders but for the broader AI industry that heavily relies on its innovations.